ohio sales tax exemption form contractor

Contained in the saving clause of a tax treaty to claim an exemption from US. Miami County Property Records are real estate documents that contain information related to real property in Miami County Ohio.

61 Pa Code 31 13 Claims For Exemptions

This form may be obtained on the website of the Streamlined Sales Tax Project.

. The purchaser is exempt. Production companies must spend more than 50000 in Massachusetts to qualify for the payroll credit. The claimed exemption must be allowed by Indiana code.

Local Sales Tax will remain imposed at a tax rate of 1. As a convenience if your sales occur exclusively in the district you can report and pay this tax as a part of the Special District Excise return. The product or service is used for an exempt purpose.

Find Ohio residential property records including property owners sales transfer history deeds titles property taxes valuations land. This tax is in lieu of the 6 sales tax that would be imposed on sales and services provided within the district. The only exception to this is to file an annual Exemption Form if you are registered with the tax department as retired andor disabled and your income is not subject to municipal income tax.

How to use sales tax exemption certificates in Illinois. Liens can be placed by a contractor a government agency or another kind of creditor. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

State Issued Exemption Certificate - DR-14. Indiana General Sales Tax Exemption Certificate Form ST-105 Form ST-105 State Form 49065 R5 6-17 Indiana Department of Revenue General Sales Tax Exemption Certificate Indiana registered retail merchants and businesses located outside Indiana may use this certificate. There are three reasons why a sale may be exempt from sales or use tax.

State Issued Exemption Certificate - DR-14. For purchases 1000 provide vendor with Utah Sales Tax Exemption Contract TC-73 PDF Form expires 7202019 For purchases over 1000 provide vendor with Utah Exemption Certificate TC-721 PDF ReligiousCharitable Sales Tax Exemption Number N20796. Ohio Revised Code 71827 requires the Tax.

In this case though also send a photocopy of the taxpayers copy of the levy to the non-liable spouse. Just a side gig. Part 4 of Form 668-A or Form 8519 is generally used for this.

We help you uncover each tax advantage you deserve. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a.

Tax on certain types of income you must attach a statement to Form W-9 that specifies the following five items. No matter how you define your work weve got you covered. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a.

No Exemption for Contractors. How to use sales tax exemption certificates in Arkansas. Taxohiogov Real property outside this state if such materials and services when sold to a construction contractor in the state in which the real property is located for incorpora-tion into real property in that state would be exempt from a tax on sales levied by that state.

Free Ohio Property Records Search. Partnerships are required to file as entities on the net profit or loss derived from sales made. TaxAct Online 2021 Self Employed Edition guarantees maximum tax benefits for filing 1099-MISC.

Reason for Tax Clearance request. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. First four digits of GSA CC or a Hard Copy of your PO.

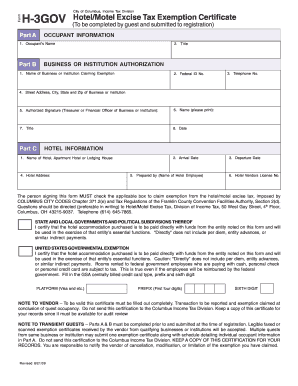

Applications will be processed within 5-7 business days. This business license application is to obtain a business license in the following municipalities additional information may be required. Exemption from state sales tax applies to hotel occupancy.

A hospital facility entitled to exemption under RC. Community Reinvestment Area Tax Exemption Program Application Fillable Form Construction Dumpster Trailer Shed Moving of Buildings Application last revised 2011 Fillable Form Contractor Registration Packet 2022. In order to qualify for the production credit and sales tax exemption production companies must spend at least 75 of the total budget or filmingprincipal photography days in Massachusetts.

The product or service is specifically exempt. Dept of Administration bid submission University of Kansas contract State employment Buyingselling business Local government bid submission Fort Hays States university contract Lottery Grantloan application License renewal ABC liquor license Vehicle dealer Roofing contractor or subcontractor Other. The state does not offer film tax incentives.

Services are subject to the state sales tax plus applicable municipal tax unless exempt from sales tax. If you received a 1099-NEC 1099-MISC or 1099-K youre in the right place. If a levy is served on wages salary or other income the statement of exemptions.

Generally this must be the same treaty under which you claimed exemption from tax as a nonresident alien. Tax Lien This type of lien is put on your property by a. First four digits of GSA CC or a Hard Copy of your PO.

H 3gov Fill Online Printable Fillable Blank Pdffiller

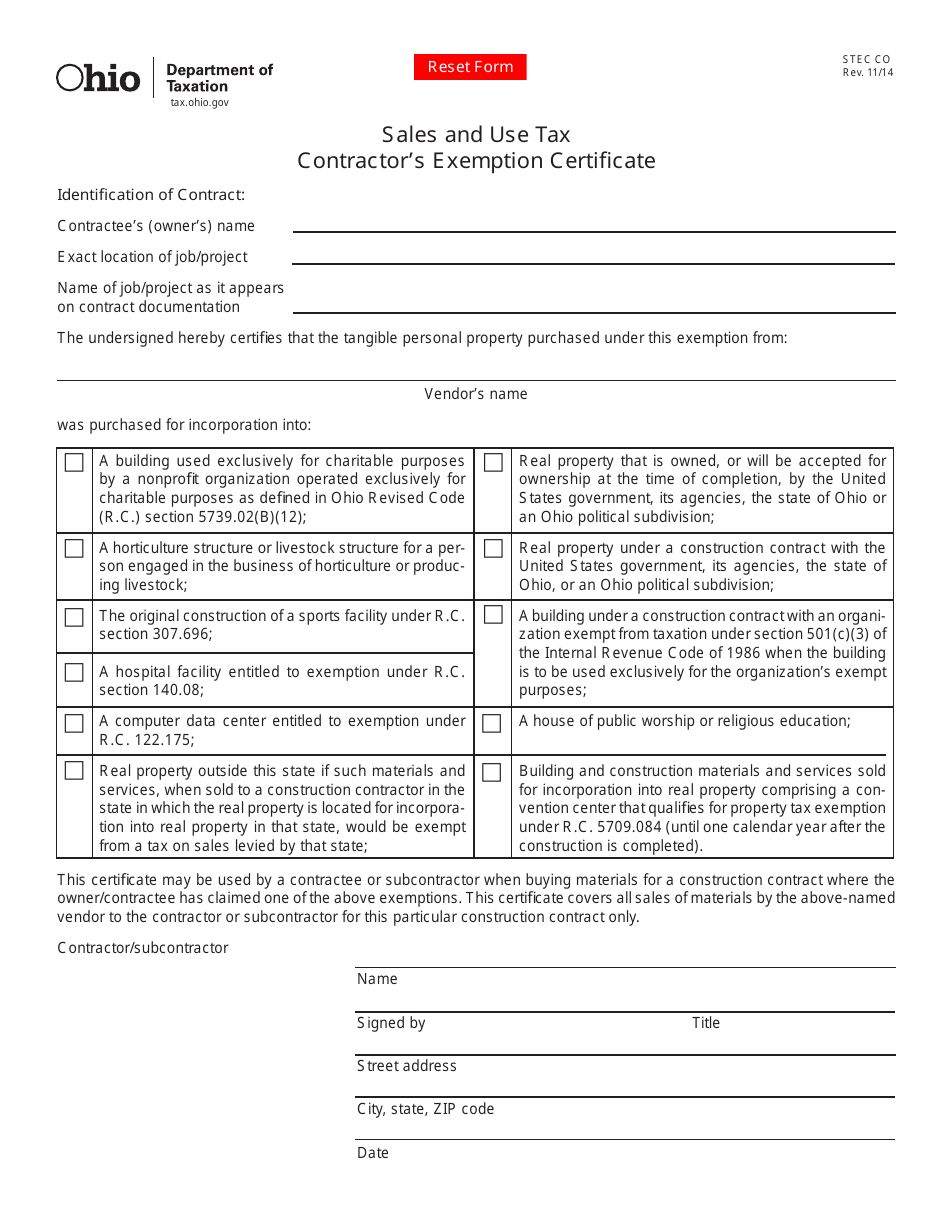

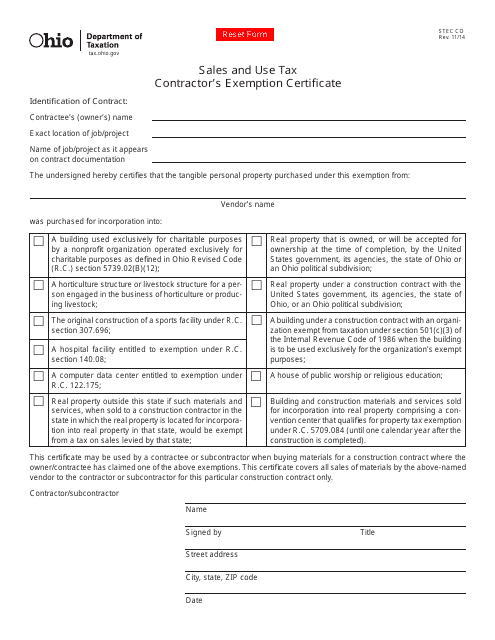

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller

Form Stec Co Fillable Contractor S Exemption Certificate

Word Google Docs Apple Pages Free Premium Templates Contract Template Agreement Free Brochure Template

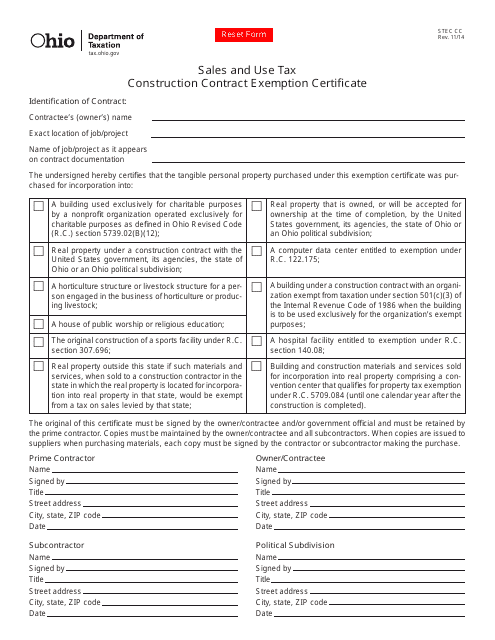

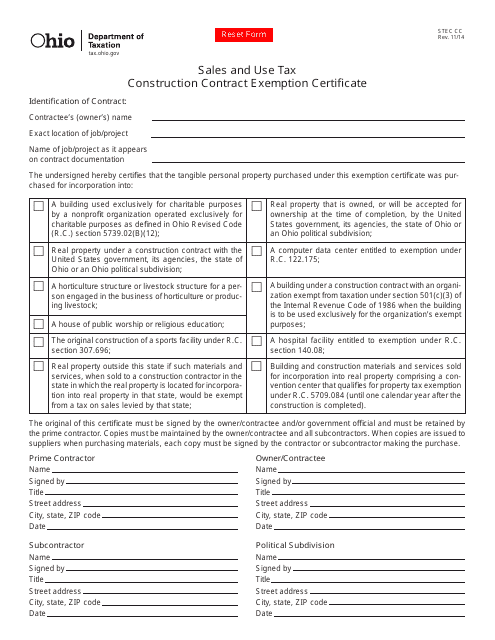

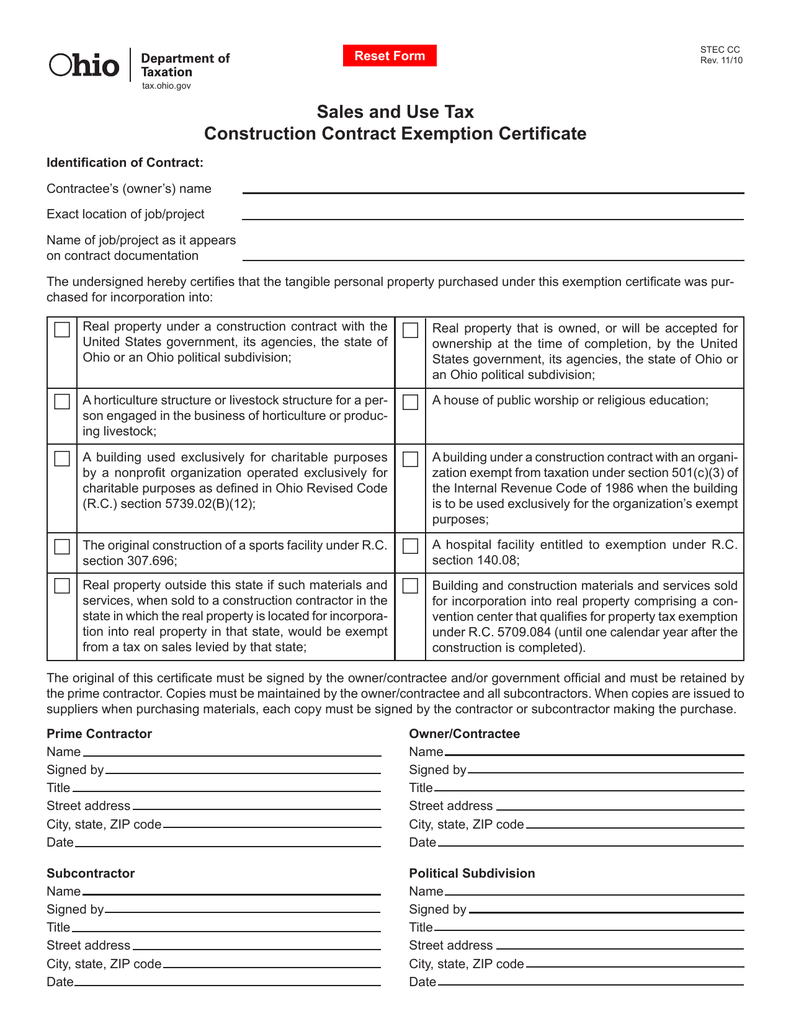

Form Stec Cc Download Fillable Pdf Or Fill Online Sales And Use Tax Construction Contract Exemption Certificate Ohio Templateroller

Key Issues Tax Expenditures Types Of Taxes Infographic Tax

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

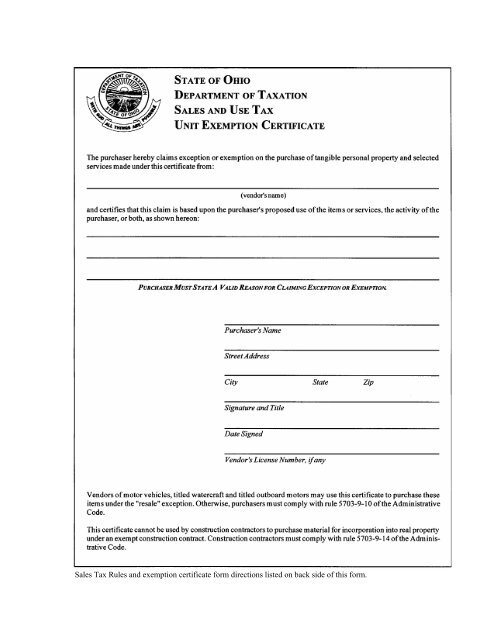

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Printable Arizona Sales Tax Exemption Certificates

Ohio Tax Exempt Form Holland Computers Inc

Sales And Use Tax Construction Contract Exemption Certifi Cate

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Kentucky Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

H 3gov Fill Online Printable Fillable Blank Pdffiller

Most Youth Sports Organizations Don T Have 501 C 3 Tax Exempt Status

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Oh Stec Co 2014 2022 Fill Out Tax Template Online Us Legal Forms