can you go to jail for not paying taxes in us

But its highly unlikely unless you owe hundreds of thousands of dollars. As with failure to file taxes you can also go to jail for failure to pay taxes.

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

Finally issues stemming from breaking federal law not paying child support and not paying court fees when youre financially able can all also land you in jail.

. Its possible to get a divorce without paying a dime. If you fail to adhere to post-judgment court procedures you can be placed in jail for contempt. Aug 03 2022 3 min read.

855 787-1922 Talk to sales. The process is relatively simple. Users who need.

You can make a creditdebit card payment or electronic transfer from your bank account either checking or savings online using the Paymentus. Sorry to end on a downer but as an 18-year-old you are responsible for your own actions and decisions. The amount of child support you owe was originally determined using your income and financial assets and obligations based on reports provided at that time.

To find out how much you owe in property taxes go to the Property Information Search and enter your house number only. What Happens at an Ex Parte Hearing. Go to adult jail.

You will also be responsible for submitting your tax returns and paying your taxes. However circumstances do change. There is 10-year a statute of limitations on collecting late taxes.

You can file it yourself or have a professional file for you. Specifically unreported income a false statement the use of an impermissible accounting or banking service or declaring too many deductions are things that could initiate an audit which could then rise to the level of an IRS criminal investigation process. All other past due taxes are surrendered for collection on July 1st of the year the taxes became delinquent and are also subject to the additional 15 or 20 collection fee.

A simple mistake oversight or your accountants malpractice may trigger an IRS criminal investigation. Also if you dont comply with a debt examination you can go to jail. If you are planning to file for divorce in California you need to know the advantages of an uncontested divorce the procedures involved and how to May 02 2022 4 min read Your Guide to Texas Divorce Forms.

If you cant pay your taxes. You cannot go to jail for making. On this page you will find some of the most commonly asked questions that our office receives regarding property taxes.

What If You Filed Your Taxes And Forgot A W-2. Of course a good tax adviser should still save you more than their fee so this should not be a major concern. In fact this can happen many.

And if many years have passed you may have gotten lucky. You have many different options for paying your property taxes. The Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check ACH.

GO In JailJust Visiting Free Parking and Go to Jail. Loss of some tax reliefs. Can I Go To Jail For Filing My Taxes Incorrectly.

If you ever need to sell a property held in a limited company then you should be aware that companies do not pay Capital Gains Tax CGT on the profit like an individual would. Tax evasion is an illegal practice where a person organization or corporation intentionally avoids paying his true tax liability. Those caught evading taxes are.

2022 3 min read. The Monopoly game-board consists of forty spaces containing twenty-eight propertiestwenty-two streets grouped into eight distinct color groups four railroads and two utilitiesthree Chance spaces three Community Chest spaces a Luxury Tax space an Income Tax space and the four corner squares. When you turn 18 you can finally go on a cruise by yourself.

If youre not able to find the information youre looking for You can contact the Clark County Treasurers Office. How to File a Divorce in Florida Can you use Floridas simplified dissolution of marriage. In general property taxes are the responsibility of the County Treasurer.

If they serve alcohol on the premises then you have to be 21. If you filed your taxes and forgot to include a W-2 you should immediately file an amended return and include the W-2. Check my order status.

Irs Tax Problems 10 Celebrities Jailed On Tax Evasion Charges Https Www Irstaxapp Com Irs Tax Problems 10 Celebrities Jailed On Tax Ev Irs Taxes Irs Jail

Tax Day Ecards Free Tax Day Cards Funny Tax Day Greeting Cards At Someecards Com Accounting Humor Accounting Jokes Taxes Humor

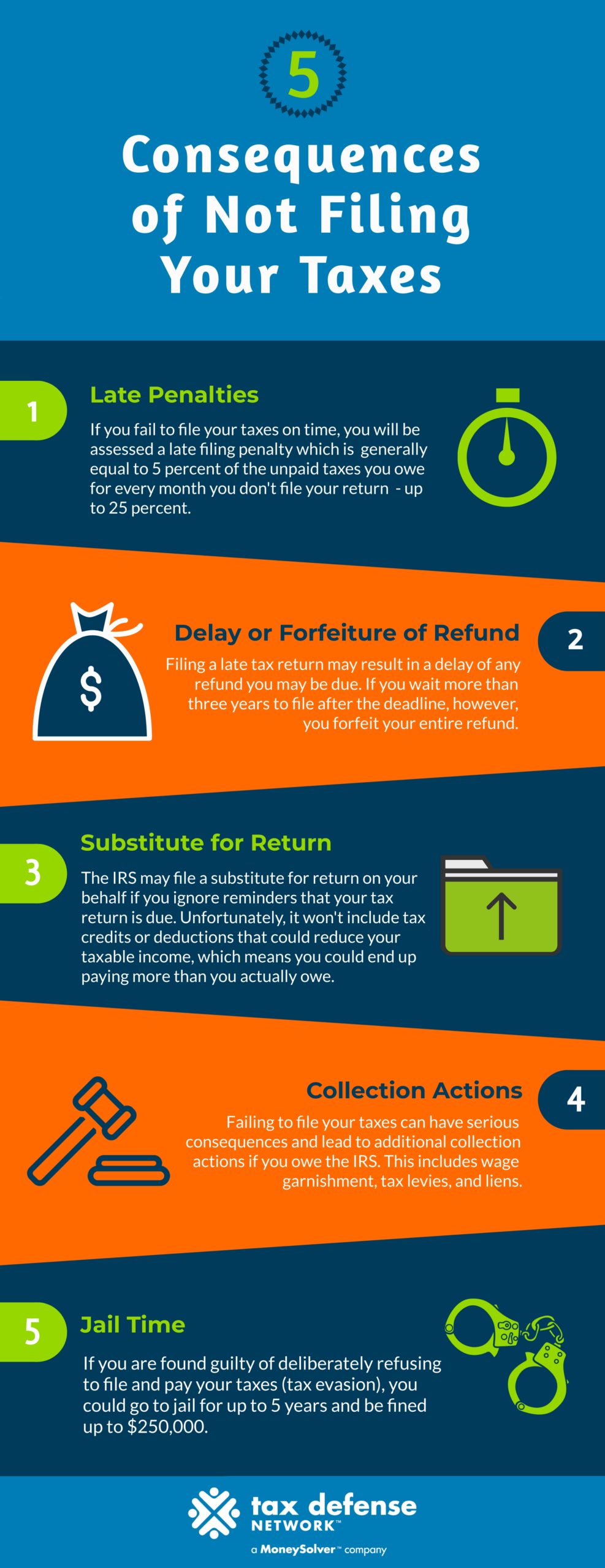

Consequences Of Not Filing Or Paying Federal Or State Taxes Tax Group Center

Can You Go To Prison For Not Paying Or Not Filing Your Taxes

The Consequences Of Not Filing Taxes

Government You Owe Us Money It S Called Taxes Me How Much Do I Owe Gov T You Have To Figure That Out Me Ijust Pay What I Want Gov T Oh No We Know

Can I Go To Jail For Tax Evasion In North Carolina Dewey Brinkley Law

Humblymybrain On Twitter Tax Quote Life Captions Joe Rogan

How Trump Gets Away Without Paying Taxes Salon Com

This Is The City That Pays The Most In Property Taxes Estate Tax Property Tax Tax Attorney

Tax Protest Boycott What Happens When You Don T Pay Taxes Money

What Really Happens When I Don T File For My Tax Return Incometax Tax Taxseason Money Finance Irs Taxevasion Income Tax Tax Return Taxact

What Is The Penalty For Not Filing Taxes Forbes Advisor

Who Goes To Prison For Tax Evasion H R Block

Become Free Of Irs Slavery How To Legally Stop Filing And Paying Income Tax Peymon Mottahedeh

Can You Go To Jail For Not Paying Taxes

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

What If A Small Business Does Not Pay Taxes

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays